Newsletter commentary Mar 2024

Time:2024-04-01

Time:2024-04-01

After experiencing a significant rebound in February, the market entered a consolidation phase in March with relatively little volatility. The market is awaiting further economic signals.

We believe that there are some very positive changes taking place in the securities market, which are favorable for investors.

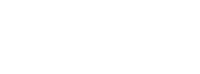

Historically, the supply and demand of stocks have had a significant impact on stock prices. Compared to the previous market peak, the total market capitalization has far exceeded that level. However, the current index still lags far behind the peak, largely due to the significant decrease in valuation. This is driven by the dynamics of supply and demand.

Currently, CSRC has imposed new requirements on IPOs, refinancing, and major shareholder reductions. These requirements impose restrictions on the supply of stocks, which is beneficial for improving the supply-demand relationship and facilitating a potential increase in valuation.

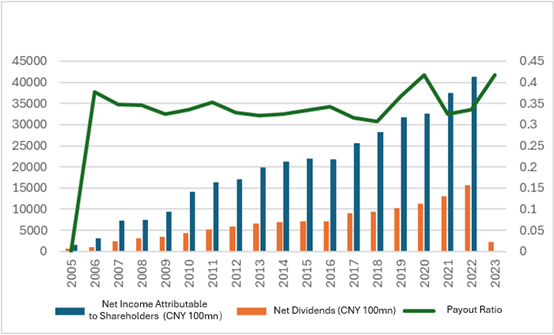

Furthermore, the emphasis on dividend payments and share buybacks is rapidly enhancing the investment value of stocks. Taking the Shanghai and Shenzhen 300 Index as an example, the dividend payout ratio for the 2022 fiscal year is around 38%, implying a dividend yield slightly above 3%. This is higher than the yield of 10-year and 30-year government bonds, which are around 2.3-2.4%. With further increases in the dividend payout ratio, the attractiveness of stocks relative to bonds will continue to improve.

From the distribution plans already announced for the 2023 fiscal year, many companies show signs of significant improvement compared to 2022. Considering the cycle of capital expenditure, regulatory guidance, and the intentions of various stakeholders, increasing returns has become a trend with good sustainability.

Again, we believe this will provide a solid underlying value for the stock market and contribute to market stability.

Last year, the inflation rate was relatively low, making a negative contribution to nominal GDP. However, in the past three months, the inflation rate has turned positive on a month-on-month basis. We expect to see a modest inflation rate increase of around 1% this year, which is a favorable business environment change compared to last year. This is beneficial for the recovery of corporate profit margins. Looking at the industrial enterprise profits for January and February, there are clear signs of recovery.

In March, some high-frequency data showed a slight weakening, but it is different from the weakening trend observed last year after the release of pent-up demand following the containment of the pandemic. Real estate data has been particularly sluggish, but with a lower base effect, we can expect some improvement in the future. Furthermore, the anticipation of further policy support and relaxation is also worth considering.

The total demand for both new and existing homes indicates that there is still considerable demand for home purchases. Due to concerns regarding issues such as delivery of newly constructed properties, many buyers have shifted their focus to the secondary market. We hope that policies related to ensuring the timely delivery of newly constructed properties will be further developed, which could help restore demand for new homes. The current apparent demand for new homes is influenced by unfavorable price expectations and factors that lead to delayed purchases, and it is not in a balanced level.

In conclusion, we anticipate that the overall business environment will improve gradually compared to last year.